Wealthboard. FIRE Faster.

Wealthboard. FIRE Faster.

Track everything in one dashboard.

Track everything in one dashboard.

Google Sheets

Google Sheets

Personal Finance

Personal Finance

FIRE

FIRE

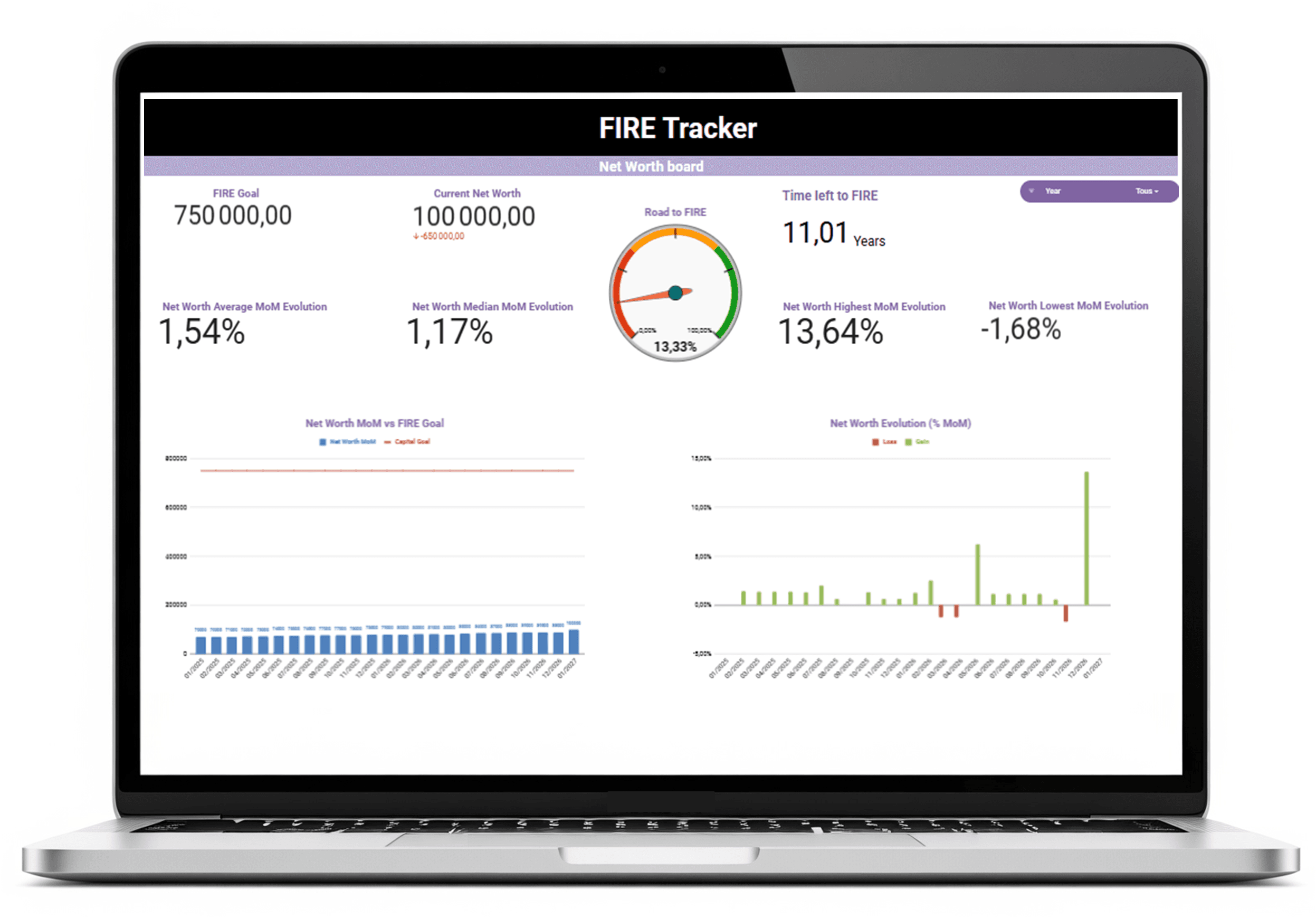

Track Your Progress Month After Month.

Track Your Progress Month After Month.

Track Your Progress Month After Month.

Watch your net worth grow, your savings compound, and your time to FIRE shrink. No more guessing, everything is visual, clear, and personalized. Your financial future, made simple.

Watch your net worth grow, your savings compound, and your time to FIRE shrink. No more guessing, everything is visual, clear, and personalized. Your financial future, made simple.

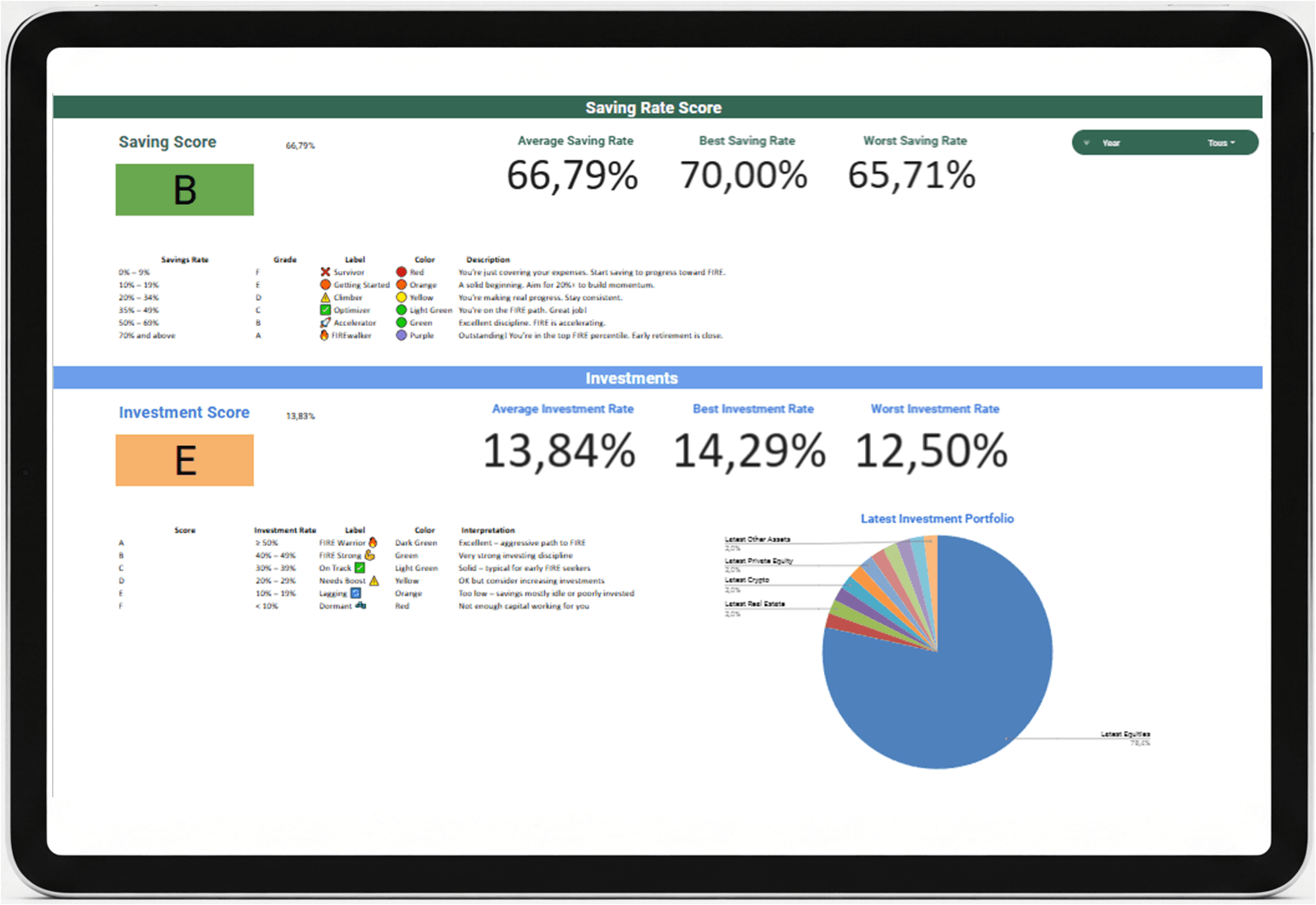

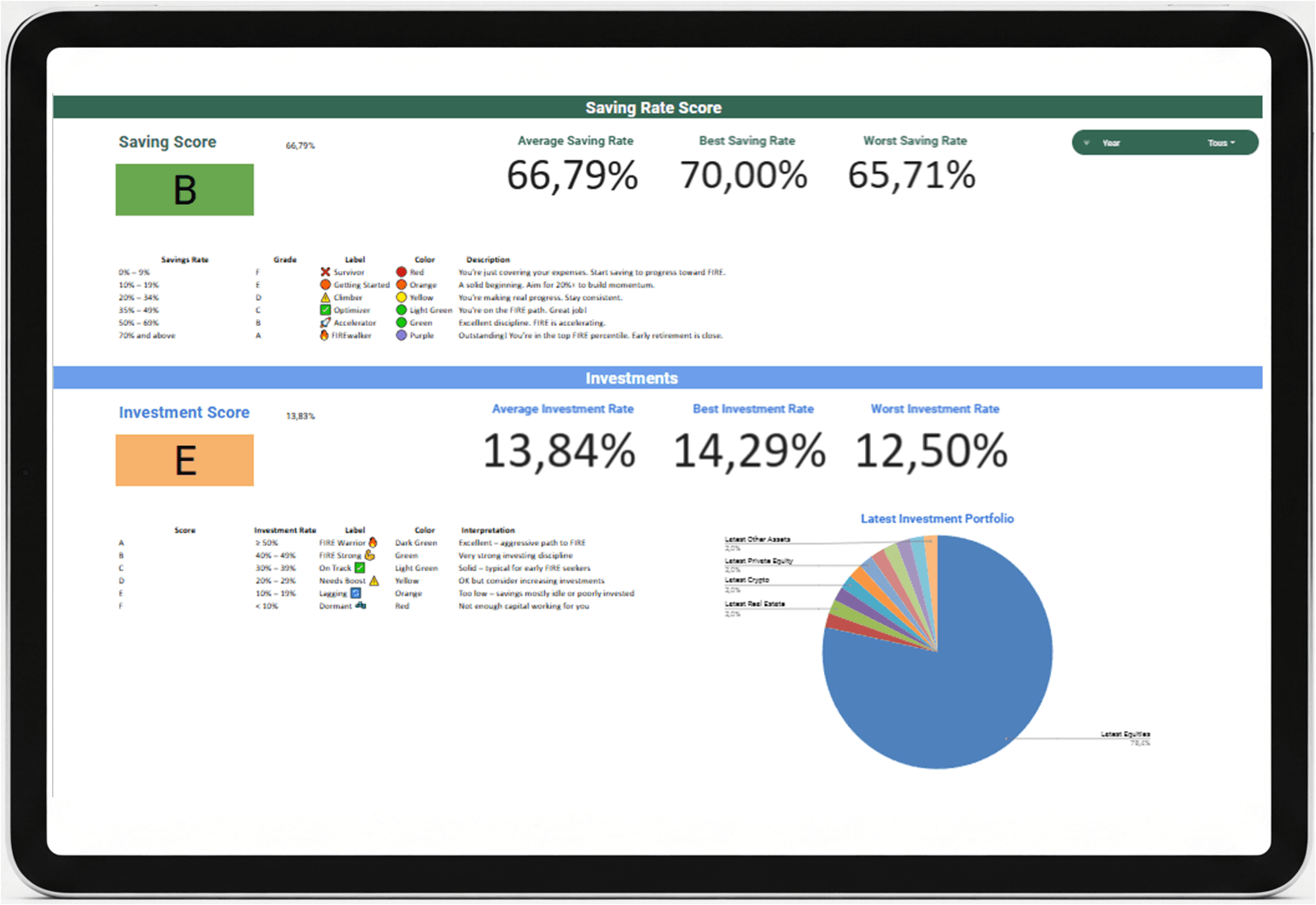

Are You FIRE-Ready?

Your score reveals how aggressively you're building wealth. Aim for an A+ to fast-track your journey to financial independence.

No Jargon. Just Numbers That Matter.

No Jargon. Just Numbers That Matter.

No Jargon. Just Numbers That Matter.

Get your FIRE timeline based on how fast your wealth is actually growing, factoring in your real savings habits, investment returns, and lifestyle. No guesswork, just a personalized, evolving FIRE roadmap that reflects your financial truth.

Get your FIRE timeline based on how fast your wealth is actually growing, factoring in your real savings habits, investment returns, and lifestyle. No guesswork, just a personalized, evolving FIRE roadmap that reflects your financial truth.

✨ Ready to stop guessing and start tracking?

✨ Ready to stop guessing and start tracking?

This dashboard isn’t just a calculator, it’s your command center for financial independence. Track real progress, get instant feedback, and finally get your sh*t done.

This dashboard isn’t just a calculator, it’s your command center for financial independence. Track real progress, get instant feedback, and finally get your sh*t done.

Get the dashboard on Gumroad.

Get the dashboard on Gumroad.

[PREMIUM] Access The FIRE Tracker Board

[LIGHT] Access The FIRE Tracker Board

How does the dashboard calculate my FIRE date?

Most FIRE calculators only look at your income and assumptions. This dashboard goes much deeper: it factors in your actual financial behavior, tracking your net worth velocity over time. In other words, it doesn’t just ask how much you earn, it tracks how fast you're building wealth based on your real savings, spending, and investment performance. Two people with the same salary and FIRE goal can end up with completely different outcomes. Why? They save at different rates They spend differently Their portfolios grow at different speeds This dashboard captures all of that. It dynamically adjusts your FIRE date based on how your financial life is evolving, making it more accurate, more honest, and more personal than any static calculator.

How do I use the dashboard?

Start by filling in the “Goals” tab. Then each month, update the Net Worth, Income & Expenses, and Investment Portfolio tabs. Only fill in the yellow-highlighted cells everything else updates automatically.

How is this different from a basic FIRE calculator online?

Most online calculators give you a one-time estimate based on rough assumptions. This dashboard lets you track your real progress month after month, using your actual net worth, income, expenses, and portfolio data not just hypothetical inputs.

How does the dashboard get my FIRE date?

Most FIRE calculators only look at your income and assumptions. This dashboard goes much deeper: it factors in your actual financial behavior, tracking your net worth velocity over time. In other words, it doesn’t just ask how much you earn, it tracks how fast you're building wealth based on your real savings, spending, and investment performance. Two people with the same salary and FIRE goal can end up with completely different outcomes. Why? They save at different rates They spend differently Their portfolios grow at different speeds This dashboard captures all of that. It dynamically adjusts your FIRE date based on how your financial life is evolving, making it more accurate, more honest, and more personal than any static calculator.

How do I use the dashboard?

Start by filling in the “Goals” tab. Then each month, update the Net Worth, Income & Expenses, and Investment Portfolio tabs. Only fill in the yellow-highlighted cells everything else updates automatically.

How this differs from a basic FIRE calculator?

Most online calculators give you a one-time estimate based on rough assumptions. This dashboard lets you track your real progress month after month, using your actual net worth, income, expenses, and portfolio data not just hypothetical inputs.

Why not just use a free FIRE calculator instead?

Free calculators are great to start dreaming, but this dashboard helps you stay consistent and committed. It shows trends, growth, and savings scores over time turning FIRE into a process, not just a prediction.

What does this dashboard offer that online tools don’t?

✔️ Savings and investment score (A–F) ✔️ Year-to-year progress tracking ✔️ Monthly net worth updates ✔️ Visual charts & progress bars ✔️ FIRE date based on your own data ✔️ Full privacy, no sign-in or data sharing ✔️ Fully editable, adapt it to your own strategy

Who is this dashboard made for?

It’s made for people serious about achieving FIRE, whether you’re just starting or already building wealth. It’s more than a calculator: it’s your personal FIRE control panel, always ready, always growing with you.

Why not just use a free FIRE calculator?

Free calculators are great to start dreaming, but this dashboard helps you stay consistent and committed. It shows trends, growth, and savings scores over time turning FIRE into a process, not just a prediction.

What does this dashboard offer?

✔️ Savings and investment score (A–F) ✔️ Year-to-year progress tracking ✔️ Monthly net worth updates ✔️ Visual charts & progress bars ✔️ FIRE date based on your own data ✔️ Full privacy, no sign-in or data sharing ✔️ Fully editable, adapt it to your own strategy

Who is this dashboard made for?

It’s made for people serious about achieving FIRE, whether you’re just starting or already building wealth. It’s more than a calculator: it’s your personal FIRE control panel, always ready, always growing with you.

Do I need Google Sheets experience to get started?

No advanced experience is required. Our templates are user-friendly. Two Dashboards views are included : Desktop & Mobile friendly. Only fill in the yellow-highlighted cells everything else updates automatically.

Why should I buy this instead of building my own spreadsheet?

You could build your own, but it would take hours of trial, design, and testing. This dashboard is already: ✅ Fully structured and optimized 📊 Visually clean and intuitive 🔁 Dynamic and automated 🧠 Built with FIRE logic & scoring baked in It saves you time, avoids technical headaches, and helps you focus on what really matters: reaching financial independence.

Is this a one-time payment or a subscription?

It's a one-time payment, no hidden fees, no recurring charges. You buy it once and get lifetime access to the dashboard, plus any future updates for free.

Why is it possible to get different FIRE dates?

No advanced experience is required. Our templates are user-friendly. Two Dashboards views are included : Desktop & Mobile friendly. Only fill in the yellow-highlighted cells everything else updates automatically.

Why not building my own spreadsheet?

You could build your own, but it would take hours of trial, design, and testing. This dashboard is already: ✅ Fully structured and optimized 📊 Visually clean and intuitive 🔁 Dynamic and automated 🧠 Built with FIRE logic & scoring baked in It saves you time, avoids technical headaches, and helps you focus on what really matters: reaching financial independence.

Is this a one-time payment or a subscription?

It's a one-time payment, no hidden fees, no recurring charges. You buy it once and get lifetime access to the dashboard, plus any future updates for free.

👋 About me.

👋 About me.

I'm not a financial advisor or spreadsheet guru, just someone on the same journey as you.

Like many, I'm aiming to reach FIRE (Financial Independence, Retire Early) by tracking my net worth, optimizing my savings, and building long-term freedom.

I created this dashboard because I needed a clear, realistic tool to follow my own progress, and now I'm sharing it with others who want to take control and make FIRE a reality.

I'm not a financial advisor or spreadsheet guru, just someone on the same journey as you.

Like many, I'm aiming to reach FIRE (Financial Independence, Retire Early) by tracking my net worth, optimizing my savings, and building long-term freedom.

I created this dashboard because I needed a clear, realistic tool to follow my own progress, and now I'm sharing it with others who want to take control and make FIRE a reality.